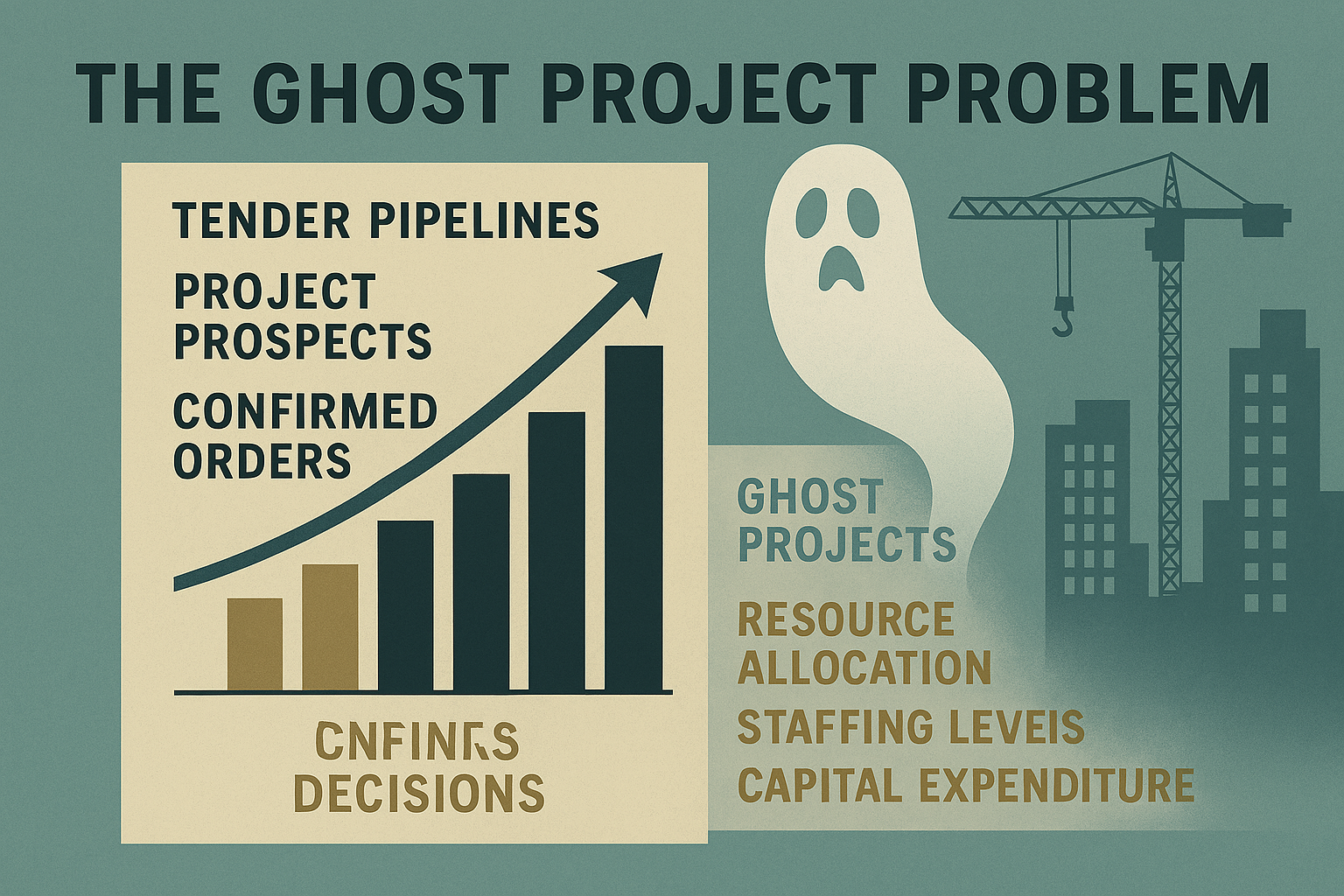

Understanding the problem of “Ghost Projects” in construction forecasting

The construction industry operates on forecasts. Companies meticulously track their tender pipelines, project prospects and confirmed orders, using these projections to inform critical business decisions ranging from resource allocation and staffing levels to capital expenditure and growth strategies. However, an insidious and often unacknowledged threat lurks within these forecasts – a phenomenon known as "ghost projects." These are proposed developments that appear in preliminary pipelines, consume valuable time and resources in initial discussions and tender preparations, but ultimately fail to materialise. The quiet proliferation of such phantom projects can lead to inflated revenue projections, misallocated resources and ultimately, stifled growth, representing a significant uncalculated risk in construction business development, writes John Ridgeway.

Ghost projects typically originate from several common scenarios within the construction ecosystem. Often, they begin as genuine client intentions or early-stage development ideas. A client might announce a future capital expenditure plan, or a developer might initiate preliminary feasibility studies for a new site. These early signals are then logged by contractors and consultants into their sales pipelines as potential opportunities. While initial intent may be real, numerous factors can derail a project before it transitions from concept to reality.

One frequent cause is funding withdrawal or re-evaluation. A project might depend on specific financing mechanisms, investor commitments, or public grants that fail to materialise or are reallocated. Economic downturns, shifts in market conditions, or unforeseen financial challenges for the client can lead to a sudden cessation of activity. The initial optimism around funding often doesn't account for the myriads of variables that can impact financial close.

Planning and regulatory hurdles represent another significant graveyard for prospective projects. Complex planning permission processes, stringent environmental impact assessments, local opposition, or changes in governmental policy can delay or entirely block a development. Projects might become embroiled in protracted planning disputes, rendering them unviable or pushing their timelines so far into the future that they effectively vanish from current considerations. The initial concept might be sound, but the practicalities of navigating a complex regulatory landscape can prove insurmountable.

Changes in client strategy or market demand also contribute to the emergence of ghost projects. A client's business objectives might shift, rendering a previously essential new facility unnecessary. Market analysis might reveal that demand for a proposed residential development or commercial space no longer exists at the projected scale, leading to a cancellation or indefinite postponement. These strategic pivots, while rational for the client, leave contractors with empty pipeline slots.

Furthermore, speculative tenders and competitive dynamics can create artificial pipeline inflation. Developers or main contractors might issue broad requests for proposals (RFPs) to gauge market pricing or test various design concepts, without a firm commitment to proceed. Subcontractors and specialist firms might invest significant resources in tendering for projects where the main contractor itself is still highly speculative, or where the project ultimately falls to a competitor, taking it out of the original firm's attainable pipeline. The sheer volume of exploratory tenders can mask the genuine likelihood of a project progressing.

The economic Fallout and missed opportunities

The silent presence of ghost projects in a company's forecast can lead to a series of detrimental economic consequences that are rarely quantified or attributed directly to these phantom opportunities. The most immediate impact is on financial forecasting. If a significant portion of a company's projected revenue or workload is tied to projects that never materialise, the annual or quarterly financial outlook becomes overly optimistic. This can lead to misjudgements in investor relations, internal budgeting and the setting of unrealistic performance targets. The subsequent failure to meet these projections can damage investor confidence and internal morale.

Chasing ghost projects consumes tangible resources. Sales and business development teams dedicate considerable time to cultivating relationships, attending preliminary meetings and preparing bids. Estimating departments invest hours in cost calculations and technical proposals. Legal teams review early-stage contracts. Marketing efforts might be directed towards showcasing capabilities relevant to specific, but ultimately non-existent projects. All of this represents a direct cost in terms of salaries, overheads and administrative expenditure that yields no return. This misallocation means that valuable human and financial capital is diverted from pursuing genuine, viable opportunities.

Time and resources spent on ghost projects are opportunities lost elsewhere. If a business development manager spends 30% of their time on a project that evaporates, that 30% could have been invested in nurturing a different, more promising lead. The company might also miss out on legitimate contracts, fail to develop relationships with genuinely active clients, or be too stretched to respond effectively to live opportunities because its resources are tied up in phantom pursuits. This opportunity cost is particularly damaging in competitive markets where timely and focused engagement is critical for securing new business.

Long-term strategic planning is heavily influenced by anticipated workload. If a company plans for workforce expansion, capital equipment purchases, or new market entry based on a misleading pipeline, these strategic decisions can backfire. Over-hiring in anticipation of projects that don't arrive leads to redundancy costs or underutilised staff. Investments in new machinery for phantom projects result in idle assets. This directly impacts profitability and operational efficiency, undermining the very growth strategies they were intended to support.

Repeatedly investing effort in projects that vanish can also lead to disillusionment among sales, estimating and project management teams. When significant time and effort are expended with no tangible outcome, morale can suffer. Furthermore, if project pipelines are consistently inaccurate, trust in internal forecasting mechanisms can erode, leading to a breakdown in inter-departmental collaboration and strategic alignment.

Spotting the red flags

Identifying ghost projects early enough requires a proactive and critical approach to pipeline management. Companies must move beyond simply logging potential leads and develop robust methodologies for assessing their viability. Several red flags can indicate a project is unlikely to materialise.

For example, projects lacking clear, well-defined scopes or where client requirements frequently change without a coherent direction often indicate internal indecision or a lack of firm commitment. A project that cannot articulate its core purpose or parameters is less likely to progress.

If a project's funding source is unclear, unconfirmed, or dependent on highly speculative external factors, its viability is also questionable. Delays in securing financing, or reliance on government grants yet to be approved, should trigger immediate caution.

Projects that remain in preliminary feasibility, conceptual design, or pre-planning stages for unusually long periods without moving forward can also be ghost projects. While complex developments naturally have lengthy early phases, an indefinite state of limbo often signifies deeper issues.

If a project does not involve direct, consistent engagement from key decision-makers within the client organization - those with the authority to commit funds and make executive decisions - it is another warning sign. Engagement primarily with junior staff or external consultants without clear executive buy-in can indicate a lack of internal priority.

Furthermore, projects with overly ambitious or vague timelines that consistently slip without clear reasons, or those that lack defined decision points for moving from one stage to the next, often signal uncertainty. Genuine projects have a clear progression path, even if subject to reasonable adjustments. If a client or developer has a history of initiating multiple projects that do not proceed past the early stages, this pattern should be noted. Historical behaviour can be a strong predictor of future outcomes.

While some early RFPs are broad by nature, those that remain excessively generic, seeking general information rather than specific solutions, might indicate a lack of concrete planning or an exploratory exercise rather than a firm intent to build. Similarly, if a client is reluctant to share detailed information about their business case, funding, or internal decision-making processes, it can be a sign that the project's foundation is not yet solid. Genuine opportunities often involve a higher degree of transparency as trust is built.

Strategies for mitigating the ghost project threat

Mitigating the risk posed by ghost projects requires a proactive, disciplined approach to business development and forecasting. Companies should implement a stringent qualification process for every potential lead. This involves asking critical questions about budget, authority, need and timeline (BANT criteria) early in the engagement. Do not simply add every inbound inquiry to the pipeline - qualify its genuine potential.

Develop a multi-tiered sales pipeline, distinguishing between "leads," "prospects," "qualified opportunities," and "committed projects." Only move opportunities to higher tiers once specific, objective criteria are met (e.g., confirmed funding, signed preliminary agreements, planning permission secured).

Utilise historical data to refine forecasting accuracy. Analyse the conversion rates of different types of leads and clients. Identify common failure points for projects that have dropped out of the pipeline in the past. This data can inform realistic probabilities for future projects.

Establish regular, disciplined review meetings for the sales pipeline. Projects that fail to advance within predefined timeframes should be flagged for reassessment, re-qualification, or removal from the active pipeline. This prevents resources from being indefinitely tied to stagnant opportunities.

Prioritise deeper relationships with key clients and developers rather than a high volume of superficial engagements. Strong relationships can provide earlier and more accurate insights into a project's genuine viability, allowing for more informed resource allocation.

Supplement internal forecasting with external market intelligence. Stay abreast of economic indicators, policy changes and industry trends that could impact project viability. Understanding the broader market context can help identify risks to a project's progression.

Most importantly, foster a culture of transparency where sales and estimating teams are encouraged to honestly assess project viability, even if it means admitting a project is a ghost. Avoid a culture that incentivises simply by filling the pipeline with unverified prospects.

The pervasive but often unacknowledged threat of "ghost projects" represents a silent drain on the construction industry's efficiency and profitability. Inflated forecasts, misallocated resources and lost opportunities are the hidden costs of relying on project pipelines that fail to materialise. By understanding the common reasons projects vanish and by implementing rigorous qualification processes, data-driven forecasting, and disciplined pipeline management, construction firms can significantly mitigate this risk. Moving beyond a reactive approach to abandoned tenders and instead adopting a proactive, analytical stance towards project viability, is essential. This shift will enable companies to deploy their valuable resources more effectively, pursue genuinely achievable growth strategies and ultimately build a more resilient and profitable future.

Additional Blogs

Drones in Construction: Are UAVs the Future of Site Inspections?

Technology integration is necessary for construction companies to survive in this evolving industry. Unmanned aerial vehicles or UAVs, such as drones, are poised to be the next big thing in site...

Read moreThe unseen carbon cost of late design changes

There is a particular moment in almost every project when someone says, “It’s only a small change.” A wall shifts half a metre. A grid tightens. A plant room grows. A façade is reconfigured to...

Read more

When compliance becomes the enemy of good design

There is a particular comfort in compliance. It comes in the form of certificates, checklists and sign-offs. It reassures clients, satisfies insurers and protects professionals from liability. In an...

Read more